Info Center: Latest toy industry news

Stay alert to the market during this uncertain time. Get the latest updates from the industry.

21/8/20 - China Is Not Russia and This Is Not the Cold War

I came of age in the 20th century, a time when Russian Communism was a military and ideological threat to western interests. Some now want to compare the current U.S. – China disagreements with the Russian-American “Cold War” that lasted from the end of World War II to the fall of Soviet Union on December 26, 1991. I, and many of you, Americans and Russians, remember it well.

Although the Soviet Union and the United States engaged each other militarily and ideologically, they never engaged each other economically. The Soviet Union was not part of the global economy. As a result, the U.S. had no economic interests in Russia, and Russia had no commerical interests in the United States.

China, on the other hand, does not just compete with the U.S. economically, but it challenges the U.S. for world economic leadership. That is something the Soviet Union never did. Although the U.S. and Chinese economies compete, they are also powerfully intertwined.

Consider this quote from Investopedia:

China is the world’s largest emerging market economy, both in terms of population and total economic product. The country is arguably the world’s most important manufacturer and industrial producer, and those two sectors alone account for more than 40% of China’s gross domestic product or GDP. China is also the world’s largest exporter and the second-largest importer, and it contains the fastest-growing consumer market…China makes and sells more manufacturing goods than any other country on the planet.

Who consumes most of those Chinese goods, American citizens? The United States is the largest consumer market in the world. According to Global Trade Specialists Inc., The largest categories of U.S. imports from China in 2018 “…included electrical machinery ($152 billion), machinery ($117 billion), furniture ($35 billion), toys and outdoor equipment ($27 billion), and plastics and plastic parts ($19 billion).”

And if you think it’s easy to move manufacturing from China to another country think again.

Each nation has a unique business culture that demands a very long learning curve.

Each country has an infrastructure that may or may not have reliable port facilities, roads and electrical power.

Each nation has a different form of government, different bureaucratic rules, language, work ethic, sense of time, and timing.

When the world’s biggest consumer and the world’s biggest manufacturer compete, it’s in their mutual best interests to find a solution. And I think they will. Yes, both sides are going to argue, and threats will be made, but there is simply too much to lose by attempting to unravel mutual interests that have taken decades to weave.

- Posted by Richard Gottlieb in Global Toy News

21/05/20 - Mattel during COVID-19: A Conversation with Steve Totzke, Mattel CCO (Global Toy News)

Listen in as Richard and Chris talk with Steve Totzke, Chief Commercial Officer of Mattel. In this lively conversation, the three discuss Mattel's response to the pandemic, changes in sales processes, the future of manufacturing in Asia, how technology is amplifying the sales process, and much more. Totzke, a Mattel and toy industry veteran, draws on his global experience, and his love of play in talking about these issues.

In The Endcap, Chris and Richard talk about the economic impact of COVID-19 on the culture, the toy industry, and thoughts about life returning to "normal," whatever that may be. (26 minutes)

This episode is brought to you by our lead sponsor KidStuff Public Relations.

- Posted by Richard Gottlieb in Global Toy News

07/05/20 - 6 Reasons Why Toy Production Will Stay in China (Global Toy News)

The current economic environment is chaotic. What we are experiencing is unprecedented with an uncertain time frame and an unknowable outcome that destabilizes governments, institutions, and businesses.

In such an environment, it is not surprising that we are seeing growing acrimony between the U.S. and Chinese governments. There is fingerpointing and threats being issued by both sides.

It is difficult to make any kind of forecast amid this kind of turmoil. Never-the-less I will make this prediction: The U.S. - China toy industry trade relationship will be little affected. Chinese companies will continue to manufacture toys for American companies, and toy trade will stay at close to current levels.

Here is how I come to this conclusion:

Toys are different.

1. Toys are not essential to national security.

2. China is still a low-cost producer of toys. The hourly wage rate for toy manufacturing in China is ten to twelve times lower than in the U.S.

3. Although labor wages in Viet Nam and other Asian alternative countries are, in some cases, lower, those countries simply do not have the population, the manufacturing capacity, nor the transportation infrastructure in place to take on more production, particularly in the near-term.

4. China's toy manufacturing capacity is the largest in the world by magnitudes.

5. Should a toy company want to return production to the U.S., it would have to build factories. That can take years to move from the germ of the idea to the opening of the doors.

6. There are long-standing supply chain, economic and personal ties between U.S. and Chinese companies and their respective leaderships and have been so for decades. These are hard-wired into how we go about our business.

China has a low cost of goods, an enormous production capacity, a state of the art transportation system, a massive population, long-standing personal and professional relationships. This plus toys not being essential to national security and the lack of a realistic manufacturing alternative to China causes me to believe that the status quo within the current global toy supply chain will stay in place with little change.

- Posted by Richard Gottlieb in Global Toy News

22/04/20 - Reducing Global Supply Chain Reliance on China Won’t Be Easy (Brinks news)

The global spread of COVID-19 has sparked a clarion call to diversify supply chains away from China. But its singularity as a manufacturing location will make it hard to find alternatives.

The outbreak of the coronavirus in Wuhan in January highlighted the pitfalls of China as the dominant global manufacturer of record. A delay in orders from Chinese factories was inevitable, given the scale of dependency on Wuhan alone. According to Dun & Bradstreet, a business intelligence company, 51,000 companies have one or more direct suppliers in Wuhan, while 5 million companies have one or more tier-two suppliers in the region. The data suggests that it’s not just Southeast Asia that is dependent on Chinese suppliers — the problem appears to be much more widespread.

Another survey by the Institute for Supply Management captures the magnitude of the outbreak for global manufacturers: More than half (57%) of companies are experiencing longer lead times for tier-1 China-sourced components, while 44% are simply unprepared to address continued supply disruptions from China. A case in point — the technology giant Apple was one of the first major global companies to inform investors that it would miss Q1 revenue projections, in part due to delays in production by its China-based assembly plants. Of late, Apple had begun to move some production activities to Vietnam and India, but the company remains reliant on Chinese assembly plants to power its inventory.

The spread of the coronavirus has made one thing clear — across the technology, automotive, electronics, pharmaceutical, medical equipment and consumer goods sectors, nearly all supply chains lead back to China as the preeminent global provider of intermediate materials and components. Recognizing the risk that a dependency on China poses to national industries, some governments are offering manufacturers incentives to exit China and ease the pain of diversification. Japan is putting $2.2 billion of its COVID-19 economic stimulus package into supporting its manufacturers shift production outside of China. There’s also mounting public pressure in some countries, such as the United States, to move essential production of pharmaceuticals and medical equipment out of China and closer to home.

Indeed, the pandemic might accelerate pre-existing plans to reduce supply chain dependency on China. Alongside rising labor costs, the ratcheting of trade tensions between China and the U.S. had already pushed brands to re-evaluate their “single-source” strategies. More than 80% of fashion brands said they already planned to reduce sourcing from China, according to a July 2019 U.S. Fashion Industry Association report. Ensuring more resilience in supply chains is also likely to be a future expectation of investors, who will now be looking at the ability of companies to hedge risk in the event of continued outbreaks or other “Black Swan” events. The chairman of Wistron Corp, an iPhone assembler, told analysts that the company would locate 50% of its capacity outside of China by 2021. Simply put, the coronavirus has accelerated trends that have been evident for some time pertaining to China’s manufacturing stature.

But the reality is that a major manufacturing shift away from China is easier said than done. Even those companies that have diversified production are finding it hard to break free of China’s pervasive influence. Anticipating a rise in tariffs from the U.S.-China trade war, video game producer Nintendo had shifted the manufacturing of its blockbuster gaming console to Vietnam in 2019. Still, there is a shortage of Switch consoles in stores today due to a lack of essential components flowing to the company’s Vietnamese factories, as COVID-19 paused production by Chinese suppliers of component parts.

The global technology and consumer electronics sectors are especially reliant on China’s infrastructure and specialized labor pool, neither of which will be easy to replicate. The Chinese government is already mobilizing resources to convince producers of China’s unique merits as a manufacturing location. Zhengzhou, within Henan Province, has appointed officials to support Apple’s partner Foxconn in mitigating the disruptions caused by the coronavirus, while the Ministry of Finance is increasing credit support to the manufacturing sector. Further, the Chinese government is likely to channel stimulus efforts to develop the country’s high-tech manufacturing infrastructure, moving away from its low-value manufacturing base and accelerating its vision for a technology-driven services economy.

To this end, manufacturers are cognizant of the potential of China as a major consumer market for iPhones today and for advanced technologies such as robotics, autonomous vehicles and smart devices tomorrow. A flash poll by the Beijing-based U.S. Chamber of Commerce conducted in March shows that U.S. businesses are still bullish on Chinese consumers, despite the impact of the virus. The consumer sector had the most businesses reporting that they intend to maintain planned investments (46%), followed by the technology industry (43%).

As manufacturers examine their supply chains for a post-COVID 19 world, the imperative for greater supply chain resilience versus the attractiveness of China as a manufacturing location and tech-forward consumer market is the defining tension that they will need to navigate. The outcome is unlikely to be a clean break from China for most. Lower-value sectors, such as apparel, are most likely to expedite diversification. Indeed, many garment manufacturers have already diversified from China to the likes of Vietnam, Cambodia and Ethiopia on the basis of rising labor costs. It will be the higher-value technology and consumer electronics sectors — where the country’s manufacturing prowess and consumer potential is the most pronounced — that will find it hardest to turn away from China’s distinctive allure.

- Posted by Brinks News

07/04/20 - China will hold Canton Fair online in June (Reuters)

BEIJING, April 7 (Reuters) - China will hold Canton Fair, the country’s oldest and biggest trade fair, online in June, state television reported Tuesday quoting a cabinet meeting chaired by Premier Li Keqiang.

Canton Fair was originally scheduled to begin on April 15, but was postponed due to the coronavirus outbreak.

China will also set up 46 more cross-border e-commerce pilot zones , and extend some favorable tax policies for small firms, farmers and individual businesses to the end of 2023, it said. (Reporting by Yew Lun Tian and Colin Qian; editing by John Stonestreet).

- Reuters News

01/04/20 - The Toy Association’s Steve Pasierb Talks Coronavirus & Toy Industry (The Toy Association)

Toy Association president & CEO Steve Pasierb joined Christopher Byrne, aka The Toy Guy, and Richard Gottlieb, president of Global Toy Experts on “The Playground Podcast” this week to discuss the impact the coronavirus is having on the toy industry.

As all businesses are learning how best to navigate this new normal, Pasierb offers perspective on what challenges the toy industry may face a few months from now and provides the latest business updates on the COVID-19 crisis. Additionally, he shares insights on the many ways the Association is supporting and communicating with its members ¬ through news, updates, business resources, and more.

“The Playground Podcast” covers the topics of the toys, culture, toy history, and talks with some of the leading people in the business of toys and children’s entertainment. The podcast is available on multiple streaming services, including Apple Podcasts, Anchor.fm, Google Podcasts, Radio Public, Spotify, and Stitcher.

- Posted by The Toy Association

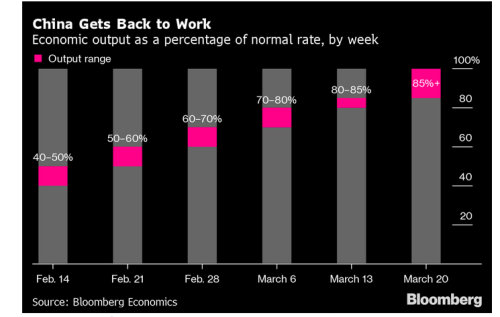

26/03/20 - China's Economy Is Getting Back to Normal (Global Toy News)

This is an excellent graph from Bloomberg Economics. It comes from the March 25, 2020, Bloomberg Balance of Power Report daily email. It shows that that economic activity is back to 85% of normal.

- Posted by Richard Gottlieb in Global Toy News

24/03/20 - Hasbro Stock Soars; maybe toys ARE an essential item (Global Toy News)

The toy industry, and Hasbro in particular, received a surprising lift with this morning's headline on CNBC: "Hasbro shares soar as CEO cites ‘great demand’ for toys, notes China supply chain coming back." The article reports that Hasbro shares are up 12%, an increase that appears to have come from Brian Goldner's appearance on the highly influential Squawk Box television show.

Brian told the audience that Hasbro was experiencing high demand for its products due to children being home and out of school. The article quotes him as follows: "...Demand for Hasbro’s games, such as Monopoly and Operation, and Play-Doh have been particularly strong. He said the company is also planning new products in response to the widespread “stay-at-home” directives being issued across the country."

Although demand for toys and games has seen a sharp increase in recent days (primarily through e-commerce), not all stocks have had Hasbro's good fortune. As of writing this (March 23 at 3:42 PM), Mattel, JAKKS, Spin Master, Funko, and Build-a-Bear Workshop are all down.

In my opinion, all toy stocks should be up. Toys have historically proven to be a safe-haven during economic downturns, and this time appears to be no different. In fact, never before have so many children, around the world, been at home at the same time.

The bottom line is this: Toys are an essential item, no matter what Amazon says.

- Posted by Richard Gottlieb in Global Toy News

23/03/20 - Toy Production Rebounding in China (Licensing International)

The disruption wrought by the coronavirus earlier this year that threatened the toy industry’s carefully orchestrated schedule of manufacturing is showing some signs of easing.

Early evidence arrived late last week when Spin Master CFO Mark Segal, in pulling the company’s financial forecast for the year, said there had been a “substantial improvement” in the Asian supply chain And it was further cemented Monday when Hasbro CEO Brian Goldner told CNBC that while the company may “miss some shipments,” it is catching up, and that its suppliers’ production will be fully caught up by April. Toy production typically resumes in February following the Lunar New Year celebration, but was delayed by the spread of the coronavirus there.

Manufacturing Capacity Increasing

Indeed the factories in China that produce more than 80% of U.S. toys are expected to be at 77% of total capacity by week’s end and 95% by mid-April, says Stephanie Wissink, Senior Analyst at Jefferies. Staffing at the plants is expected to be at 85% later this week and 95% by mid-April, she says. That’s against Chinese factories being at 50% of capacity with 56% of the workforce at the start of this month, according to a survey from the Institute for Supply Management.

Goldner hedged slightly in noting the difference in catching up with orders “is subject to what happens around the world as some markets are closing while others are still open and robust.”

Retail Buying Patterns

That variance also will hinge on retailers resuming typical buying patterns, a task made that much harder by stores closing globally in an effort to stem the spread of disease. Toy industry executives say retailers may trim orders as much as 10% as they devote more open-to-buy and shelf space to essential products such as household cleaners and food. In some cases, shelf space in toy departments is being commandeered for expanded inventory of essential household goods. And some toy categories like games and puzzles, building sets and crafts and activities have been in tight supply as parents search for activities for their homebound children.

The first half of the year – with the possible exception of Easter – typically is a slower sales period than the third and fourth quarters. For example, 6-8% toy sales come in March-April against 60-65% in November-December, say analysts. And many of the retailers that have been deemed essential in the U.S. and remain open amid the retail closings- mass merchants, drug, grocery and dollar stores — typically account for 80-85% of toy sales. And holiday toy production doesn’t typically begin until May.

The sliver of optimism in the toy industry now is in contrast to just a few weeks ago when the coronavirus was raging across China, delaying the re-opening of factories and workers’ return to them. At the time, MGA Entertainment CEO Isaac Larian estimated that shipments of the company’s new top-selling LOL Surprise products could be delayed by seven weeks and forecast overall global toy sales might decline 6-8% this year. The industry is coming off a 4% decline in U.S. sales in 2019.

- Posted by Licensing International

13/03/20 - Surviving Coronavirus; what toy companies need to do (Global Toy News)

Yesterday, the theatres in New York City went dark, the NCAA canceled March Madness, and all major professional sports leagues shut down. All this, while schools closed, churches were asked to cancel services, and the stock market plummeted.

It was astonishing to see the tipping point take place over the course of a few hours. At 11:30 yesterday, I slipped out to the grocery store only to find business as usual. At 4:30, when my life partner went out to buy groceries, she faced lines so long that they were in the shape of a "W."

Yesterday was a day that will be written about in history books. I have to say, however, that it is certainly more enjoyable to read about history than to live through it. When we read a history book, we are presented with closure. When we live through history, we experience the uncertainty of how and when things will work out.

We in the global toy industry are undergoing convulsions in our supply chain. The virus is striking different parts of the world at different, disjointed times. China was hit first and is getting back on its feet. Unfortunately, just as China is beginning to ramp up production, the consumption parts of the toy market (primarily Europe and North America) are increasingly slowing down.

In this type of environment,it is challenging to know what actions to take. I think it is essential to take a long view. Business will eventually get back to normal, in weeks or months. People will consume and factories will produce. The challenge is, therefore, to have a strategy for surviving short term and a vision for prospering long term.

Here are some suggestions for successfully rafting through the current economic white water:

· Keep in close and constant communication with suppliers and customers. Know inventory conditions, not for just for your own business but for those who supply and purchase from you.

· Don't wait for the federal government to provide a solution but plan for how your business is going to make ends meet while cash flow is limited.

· Keep a close eye on what movies, games, toys, and other entertainment properties and play products are going to be delayed.

· Ask creditors for help. It is, ultimately, in their best interest to keep you healthy.

· Look for opportunities. Are games going to be in demand (primarily through e-commerce providers) for families that want to avoid cabin fever?

· Are toys going to look appealing to parents who wish to keep their children entertained?

Despite these words of concern and caution, I feel realistically optimistic. The virus has begun to subside in China and Korea, and, with the actions that state and local governments, as well as private citizens, are taking, we should hopefully find the same hopeful ending to our moment in history hopefully sooner than later.

- Posted by Richard Gottlieb in Global Toy News

View the original article11/03/20 - Should I wait to launch my brand in China due to COVID-19? (Kung Fu Data)

The short answer…it depends.

Offline sales ground to a halt from late Jan through the end of Feb while China’s population has been under quarantine (and online sales didn’t fare much better). It’s the worst 6 weeks since our inception.

BUT…that doesn’t mean EVERYONE thinking about launching should wait. This may be one of the easiest times to launch online in China that we’ve seen in quite some time.

Let me explain…

How your business is structured and how people discover your products matters more.

So if you have some awareness and there is already a solid commercial case, don’t wait. It’s a wonderful time to make your move.

Because of the crisis, we are seeing “unprecedented” levels of support from Tmall and JD category managers. We’ve gotten more attention from their staff in the past month than in the last year.

They’re more willing to offer support, upgrades, and opportunities for brands.

Things we’ve seen so far: more free traffic resources, automatic rank advancements, optimal positioning and subsidies (funding) for strategic brands and product categories. You name it.

Bottom line…if you have a bit of traction and good fundamentals, I think it’s a great time to launch.

#China #eCommerce #Launch #Tmall #JD

- Posted by Josh Gardner @ Kung Fu Panda

View the original article10/03/20 - Lego Bets on the Chinese Consumer; Why We Should All Pay Attention (Global Toy News)

At a time when there seems to be so much disruption over the Coronavirus which followed the threat of tariffs which followed the Toys R Us collapse, it is refreshing to see a major toy company make a conspicuous commitment to the toy market.

This month Lego announced that it was opening more retail outlets in China. That's according to a Wall Street Journal article by Saabira Chaudhuri entitled: "Lego Commits to China Expansion as Revenue Climbs." As Ms. Chadhuri puts it: " it will open 150 new stores this year, mostly in China, after opening the same number last year—pushing to meet what it says is that country’s growing demand for its toy bricks."

That 150 planned stores plus the 150 opened last year plus the 60 already existing stores will bring the total of Lego outlets in China to 360. To provide some perspective on that 360 number, the U.S. has a total of 100 Lego stores. That says a lot about the potential in the Chinese market as well as Lego's confidence in global trade.

Lego is a highly valued brand in China. Last year, I led a round table discussion with Asian toy industry leaders during the Guangzhou Toy & Educational Fair. One of the things that came up was the importance of western brands to Chinese consumers. I asked whether consumers might be attracted to lower-priced versions of Lego. Attendees were quick to tell me that Chinese parents and children would be ashamed to use a lower quality product.

Bottom line: Good for Lego and good for China. And, yes, good for the toy industry.

- Posted by Richard Gottlieb - Global Toy News

View the original article03/03/20 - No Country Comes Close to China's Manufacturing Capacity. Apple Finds That Out and We All Learn. (Global Toy News)

There is a must-read article in the Wall Street Journal by Tripp Mickle and Yoko Kubota. Entitled "Tim Cook and Apple Bet Everything On China. Then Coronavirus Hit." The article is about the impact of the Coronavirus on Chinese manufacturing and the effect on Apple's production and retail sales there.

Apple employs over three million people in China. The companies products are built in factories that function at an unimaginable scale. Some employ 250,000 workers. In other words, for Apple, there is simply no other place it can go to match even a small part of China's productive capacity.

What I found of interest and what I wanted to share with you was this paragraph:

Finding a comparable amount of unskilled and skilled labor is impossible, said Dan Panzica, a former Foxconn executive. The population in China has allowed suppliers to build factories with a capacity for more than 250,000 people. The number of migrant workers in China, who do much of Apple’s production, exceed Vietnam’s total population of 100 million. India is the closest comparison, but its roads, ports and infrastructure lag far behind those in China.

Also of importance to Apple is that, according to the article, one-fifth of Apple's revenue comes from sales in China. If they leave, they may turn off the Chinese government and the country's consumers who love Apple products. How many toy companies are aware that so many Chinese citizens have the money to afford Apple products that it is 20% of the company's revenue. How many toy companies are getting 20% of their sales out of China?

The big takeaway for those of us in the toy industry is that China works on a whole different level by a magnitude when it comes to manufacturing. Companies may want to have one or two alternative factories in other countries, but China is and will be for the foreseeable future the only place to be for manufacturing.

- Posted by Richard Gottlieb - Global Toy News

View the original article27/02/20 - The Time to Enter the Chinese Market is Now (Global Toy News)

As the recent breakout of the coronavirus, China now is the central spot for hot topics and controversy. With its dropping birth rate, some may ask: is it still the Gold mine for Infant and Toy Industry? Actually, all these should NOT scare businesses away.

According to the recent news, the birth rate in China hit its lowest in 2019. The number of newborn babies reached 14.6 million – a decrease from 17.8 million in 2016, which was the year when the second-child policy started. What matters more is that the second child accounts for 57% of the total birth.

In other words, it’s pretty obvious that young Chinese couples are reluctant to have babies! In fact, real estate prices and the growing trend of individualism seem to be the most effective contraceptive against the growth of the birth rate in China. This is not a good sign for the Infant and Toy Industries.

BUT, China is still a top growing market for toys (as well as a top growing economy if that matters). How is it possible when you have fewer babies?

Therefore, now the question can be described as how to make consumers choose my toy? Well, I guess a universal answer would be Marketing, Branding, and Positioning. They play a crucial role in the competition, which eventually leads to purchase preference. There’re plenty of successful cases across different industries to be found on the internet. Though do keep in mind that China is still failing behind a lot in terms of the average spending on a national scale. But this actually provides another opportunity for smaller businesses.

Due to the market size of China, a business only needs to capture a small proportion of the market, and that’s already enough to achieve huge success. Therefore for smaller players, one possible solution to get tapped into China is through the rural market. In a way, it helps smaller brands to avoid head-to-head competition with big names as they probably don’t have sufficient funds to burn for marketing.

An extreme-but-real example is Pinduoduo (NASDAQ: PDD, Chinese: 拼多多) – a domestic eCommerce business that targets less developed rural market for consumers who want to pay less. With its effective marketing and sharing strategy over social platforms, today it has grown to become the top 3 eCommerce platforms in China. I think they're at least two things PDD taught us:

· Never underestimate the purchasing power from a less developed region

· Never neglect the diversity of China

How long does it take from zero to being listed on the New York Stock Exchange? The answer from PDD is less than 3 years. Who knows, maybe we should expect a toy company to beat this record. After all, is what we can really dream of from the tremendous potential of China.

- Posted by Richard Gottlieb - Global Toy News

24/02/20 - Coronavirus weighs on toy industry (Yahoo Finance)

Companies are expecting to see an impact from the coronavirus in the toy industry. The Toy Insider Senior Editor James Zahn joins Yahoo Finance’s Alexis Christoforous and Brian Sozzi to discuss the details on The First Trade.

View the video11/02/20 - China is Not Alone: The Coronavirus and the Toy Industry (Global Toy News)

Franklin Roosevelt famously said, "The only thing we have to fear is fear itself." That was, of course, his calming words to an anxious Depression-era inauguration audience. We could use some of that advice now. Some are responding to China and the Coronavirus more out of fear than rationality.

I, like you, have many friends in China. We are concerned about them and their families and hope that the current scare ends soon.

Sadly, there will, for the first time in decades, be no Chinese Pavillion at the New York Toy Fair this year, and many familiar faces from China will not be in attendance. It is easy to see why. One very senior Chinese industry leader wrote to me that he could not attend because there is a fourteen day incubation period required for Chinese visitors to the U.S.

And its not just people that are being stopped. I saw this quote in a Washington Post article by David J. Lynch entitled: "Virus threatens U.S. companies’ supply of Chinese-made parts and materials." "Major airlines in the United States and Europe are halting their cargo and passenger flights to China for up to two months." I can understand the concern regarding people who may be sick, but you can't pack a virus in a box.

The toy industry is fully global, with 86% of its production taking place in China and a growing part of its revenues as well. No man is an island," and no country is either. China is not alone in this as we in the toy industry are, due to the Coronavirus, going to feel the impact of potentially significant disruptions in the supply chain over the next few months.

Yes, the Coronavirus is worrying. Just take a look at the mask-wearing citizens of Hong Kong or the empty streets of Wuhan. Let's do our part to assure that the social, political, and economic bonds between the Chinese and U.S. toy industries stay healthy while we all work our way through this global emergency.

- Posted by Richard Gottlieb - Global Toy News

View the original article

.jpg)